BAKKT will offer Bitcoin Futures with cash settlement

BAKKT will offer Bitcoin Futures with cash settlement.

The BAKKT Bitcoin Futures platform stood out from the competition like CME or Bitmex by offering Bitcoin Futures where the customer actually needs to buy ream Bitcoins and not just speculate in USD dollars on the Bitcoin BTC price.

BAKKT intends to compete with CME Group over its core business of Bitcoin Futures and gain market share.

This was stated by Adam White, Bakkt’s COO, at a Coindesk conference on November 12, 2019 in New York.

The launch of these cash-settled Bitcoin futures contracts could take place by the end of 2019.

“We also intend to offer a cash settled contract …” he said to the public.

Bitcoin Futures contracts settled in cash that would be managed by ICE Clear Singapore, the trading of these Bitcoin futures contracts would then be done on ICE Futures Singapore, a subsidiary of ICE of which BAKKT is also a subsidiary.

Logically, therefore, BAKKT continues to develop its business by directly aiming at the activity of its competitors, Bitcoin Futures settled in cash.

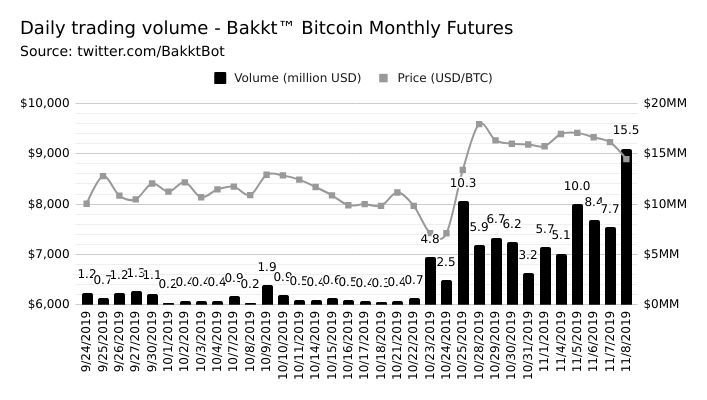

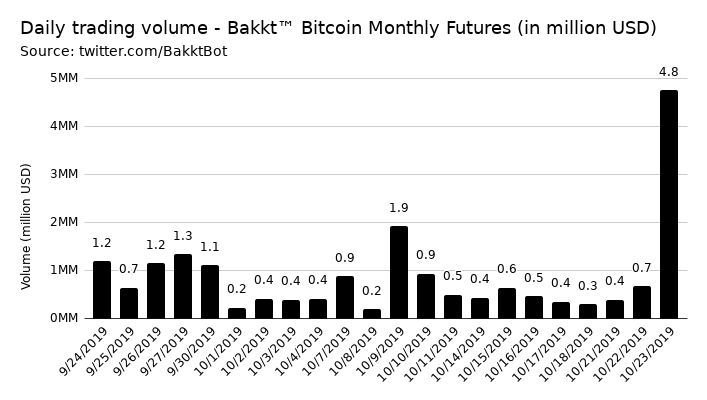

BAKKT, whose trading volume for Bitcoin Futures continues to grow and has just launched its Bitcoin secure storage offer for institutional clients.

The company also announced the launch of the first regulated option contract on December 9, 2019 and a consumer crypto application with Starbucks in 2020.