What is a crypto trading bot (Bitcoin robot)?

You heard about crypto bot, Bitcoin robot, crypto trading robot and you wonder what it is?

What is a trading robot, can you make money with automated cryptocurrency trading or Bitcoin bot trading?

Traditionnal trading

Bitcoin or cryptocurrency trading in general can be done by signing up on a crypto exchange like Binance or Kraken, buying and reselling crypto tokens hoping to make a profit.

Like conventional stock trading, it therefore takes time and knowledge to trade and make money especially with a very volatile crypto market.

Today’s technology allows computers to work in place of humans in many daily tasks, whether in a factory or in trading.

Trading actually follows cycles and trends according to certain market indicators that allow decisions to be made about buying or selling an asset like gold, stock, security or a cryptocurrency.

In crypto trading, it’s the same thing, the computer associated with artificial intelligence allows you to benefit from trading robots that will place buy or sell orders for you when you sleep or busy with something else quite simply.

The goal is to automate tasks, to be able to carry out buy or sell orders when something happens on the market when you are not available to monitor the evolution of the Bitcoin BTC price or the price of cryptocurrencies in general.

The intelligent trader robot

The crypto robot trader also called crypto bot, Bitcoin robot or trading bot will allow you to delegate the activity of trading or a part of it to intelligent robots.

They will analyze the evolution of the crypto market, its prices, its trends in order to execute the buy or sell orders that you would have taken while in front of your computer or smartphone.

Shortly after the appearance of Bitcoin created by Satoshi Nakamoto, the first trading robots or Bitcoin robots appeared like the Bitcoin robot Haasbot which is one of the best known crypto trading bots for Bitcoin BTC trading or cryptocurrency traders.

Very basic crypto bots which required certain computer skills in programming as well as in trading in order to be able to use them correctly.

The Gekko bot also appeared and met with some success, a free open source crypto trading software created by the Github community but which also requires a minimum of technical skills to use this free crypto bot.

There are also Cryptotrader, cryptohopper or Gunbot among the known crypto trading robots.

Since then, modern automated crypto trading platforms have appeared like Kryll or 3commas.

To do automatic cryptocurrency trading, you have to configure the crypto bot according to what you want it to execute as buy or sell orders on Bitcoin BTC, Ethereum ETH, Ripple XRP, Litecoin LTC, Doge, EOS, Tron TRX, BNB, Chainlink, Vechain, BAT, Zcash, Monero XMR, etc…

If you have trading skills and are familiar with the terms RSI, MACD, Bollinger, stop loss, you will be able to configure your crypto trading robots so that they execute the orders to follow that you will configure in the interface of the robot trader.

New automated crypto trading platforms

One of the main advantages of technical innovation in trading robots is that there are now much more user-friendly and modern automated crypto trading platforms that offer more options and possibilities.

Especially for people who do not have of trading knowledge but who wish to use a crypto bot or a Bitcoin robot.

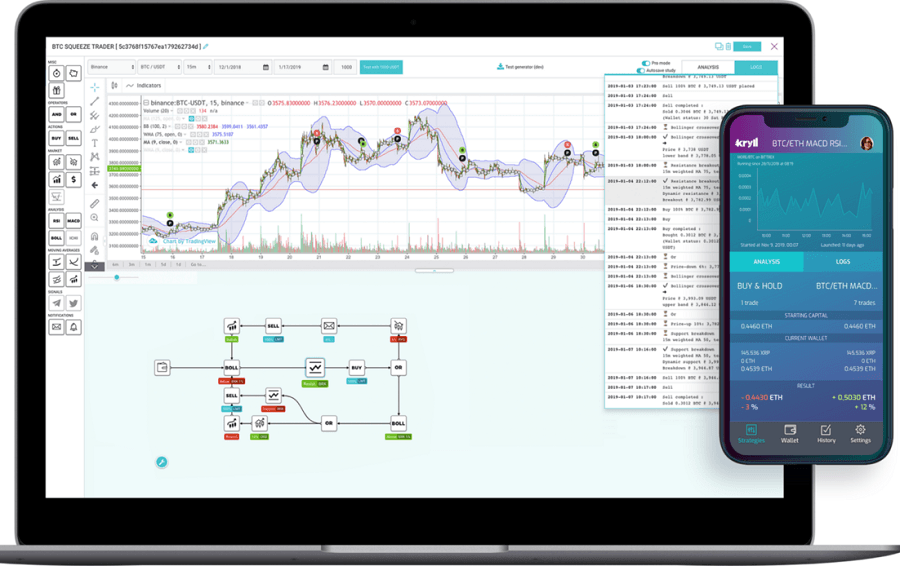

The new automated crypto trading platforms (Kryll, 3commas, Cryptohopper) offer very easy-to-use visual editors to create your trading strategies by assembling the blocks as if you were assembling legos.

These crypto trading platforms offer crypto bots and Bitcoin robots, technical support in English and different languages!

Automated crypto trading platforms like Kryll offer marketplaces where professional traders make their winning crypto trading strategies available to users who wish to use these strategies on their account in a simple and automatic way.

Copy trading or social trading which therefore allows a beginner in crypto trading to benefit from and use the skills of professional traders by following and copying the buy and sell orders they execute on their account in real time!

It also allows professional traders to rent their trading strategies and generate a passive income, earning money with crypto currencies.

Examples of crypto trading strategies with Bitcoin and crypto trading bots on the market

Traders can use crypto bots to implement various market strategies like:

Arbitrage

This strategy is best understood as a trader taking advantage of the price differential that can exist between two markets, or in this case between cryptocurrency exchanges.

With arbitrage, a trader would buy a digital asset like Bitcoin in one exchange and sell it simultaneously on another exchange.

Arbitrage was an effective strategy during the early days of the market as there were often large price differentials on different exchanges.

However, the gaps found with this strategy have narrowed as the market matures.

Market making

Crypto trading bots are also useful for market making strategy, which involves continuous buying and selling of a variety of digital spot currencies and digital derivative contracts, all with the aim of capturing the spread between the purchase price and sale price.

In other words, market making involves placing limit orders around the current market price of a digital asset, on both sides of the order book (therefore buy and sell orders) .

Over time, as the price of the digital asset fluctuates, the trader can take advantage of this resulting spread.

Trend Trading

Crypto trading robots can also be programmed to identify trends in a digital asset and execute buy and sell orders based on them, making them particularly effective for trend trading.

It is a trading strategy that attempts to capture the gains by analyzing the dynamics of an asset in a given direction.

To put it simply, trend traders will enter a long position when the momentum of an asset has an uptrend and enter a short position when it has a downtrend.

Mean Reversion

This strategy is based on the assumption of a stable underlying trend in the price of a given asset.

It assumes that if the price of the asset can fluctuate around this trend, it will eventually revert to its average or its average.

This average could be the historical average of the price or return on the asset.

This can be part of a strategy as long as a trader can execute buy or sell orders assuming that the price of a given asset will return to its average or average.

Index Fund Rebalancing

Index funds have defined rebalancing periods to bring their holdings closer to their respective benchmarks.

This creates profitable opportunities for algorithmic traders, who capitalize on expected trades that offer profits of 20 to 80 basis points depending on the number of shares in the index fund, just before the rebalancing of the index fund.

These transactions are initiated via algorithmic trading systems for quick execution and the best prices.

Strategies based on a mathematical model

Proven mathematical models, such as the delta neutral trading strategy, allow trading on a combination of options and its underlying security.

Delta neutral is a portfolio strategy composed of several positions with compensating positive and negative deltas.

A report comparing the change in the price of an asset, usually a marketable security, to the corresponding change in the price of its derivative, so that the delta of the assets in question is zero.

Volume Weighted Average Price (VWAP)

The volume-weighted average pricing strategy breaks down a large order and releases dynamically determined smaller orders into the market using historical volume profiles specific to stocks.

The objective is to execute the order close to the Volume Weighted Average Price (VWAP).

Time Weighted Average Price (TWAP)

The time-weighted average price strategy splits a large order and releases smaller dynamically determined market orders into the market using time intervals equally divided between a start time and an end time.

The goal is to execute the order near the average price between start and finish, thereby minimizing the impact on the market.

Percentage of volume (POV)

Until the trading order is completely filled, this algorithm continues to send partial orders, according to the defined participation rate and according to the volume traded on the markets.

The associated “step-by-step strategy” sends orders at a user-defined percentage of market volumes

Conclusion

Automated cryptocurrency trading works, it will depend on your trading skills as well as your computer skills if you decide to use a basic crypto bot that requires computer skills.

The new automated crypto trading platforms recently arrived on the market like Kryll or 3commas offer more modern crypto trading tools and especially technical support to help you succeed in automated crypto trading!

Easy to use visual interfaces to build your drag and drop trading strategies for example.

Automated crypto trading platforms that now even use artificial intelligence like Daneel.io to make their crypto bots and Bitcoin Robots even more efficient and intelligent in their decisions and reaction times to market movements.

With all of these recent technical innovations in crypto bots and Bitcoin robots, what are the best crypto trading bots?