87% of the volume of transactions on crypto exchanges could be fake!

87% of the volume of transactions on crypto exchanges could be fake!

According to a survey by business analysis firm The Tie, nearly 90% of the total transaction volume reported by crypto exchanges might be incorrect.

By reporting figures compiled from 97 different platforms, the researchers found that the vast majority of the volume they claim to move daily came from users who may not exist.

This numbers came out after calculating the daily transaction volumes reported by small crypto exchanges relative to other established industry giants, such as Binance or Kraken.

On this point, the company commented on its social networks:

“In total, we estimate that 87% of the volume of transactions reported by crypto trades was potentially suspect and that 75% of these platforms had some form of suspicious activity in their operations.

If each crypto exchange represented on average the volume per visit of CoinbasePro, Gemini, Poloniex, Binance and Kraken, the actual volume of trade in the 100 largest crypto exchanges in the world would be around 2.1 billion Dollars per day.

Currently, the reported number is 15.9 billion.”

In the past, several crypto exchanges have been seriously accused of false volume reports.

In this regard, Changpeng Zhao, CEO of Binance, had already mentioned in the past the possible reason for false reporting platforms, saying that pages like CoinMarketCap could contribute to this disorder:

“Why do crypto exchanges fake their volume of transactions?

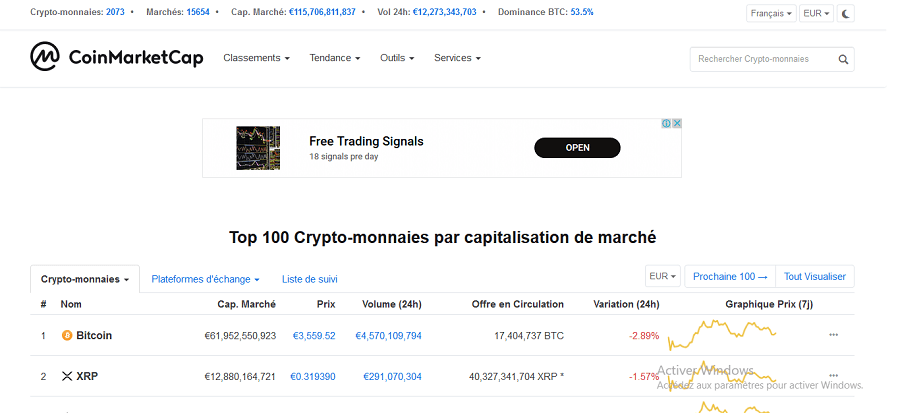

CoinMarketCap is the busiest website in our industry and the largest reference site for crypto trading.

A high ranking in the CMC has benefits for new users, even at the expense of the loss of credibility of business users.”

Recently, Kraken was involved in a similar scandal in which even his CEO accused The Block of broadcasting false news about a fake volume report.

With a very difficult bear market, any windfall to put forward better figures is welcome.

That crypto exchanges have false volumes is certainly possible, we must also recognize that a bit of fake volume makes a platform looks alive and that it would be clearly dead without any transaction.

This market is not yet regulated so each actor can still do what they want to try to attract new users or keep the ones they already have.

The next bull market should restart the machine but in the meantime, the crypto exchanges must also survive and fake volume is certainly one of their weapons to stay in this market if they still want to be here at the next Bitcoin bull run.