What is Bancor (BNT)?

What is Bancor (BNT)?

Bancor is like a smart crypto wallet, a crypto exchange and also a cryptocurrency (BNT).

Bancor is a blockchain protocol that offers users to perform conversions directly from their network.

Bancor wants to bring liquidity into the cryptocurrency market thanks to its “smart token”, the Bancor Network Token. Here is our review of Bancor.

What is Bancor?

Definition of the Bancor project

The Bancor protocol is supported by a two-headed organization.

This organization consists of a Board of Trustees and an Advisory Board, both based in the canton of Zug in Switzerland.

The Board of Trustees is made up of 4 people who lead the Bancor team.

Bernard Lietaer: Belgian engineer and economist specialized in monetary systems, and who preaches for the creation of local currencies.

Eyal Hertzog: product architect of the project, known for having founded the video sharing company Metacafé.

Guy Benartzi: was born in Tel Aviv into a software company.

Guido Schmitz-Krummacher deals with the commercial aspect of the operations.

He sits on the boards of several Swiss trading companies as well as that of Tezos (XTZ).

The project was financed by an ICO which took place during the summer of 2017.

The success of the ICO has allowed the rapid launch of the Bancor Protocol which intends to remedy the illiquidity that affects part of the cryptocurrency market.

The liquidity of any asset – crypto assets, stocks, etc. – represents the ability to buy or sell this asset quickly and without impacting its course excessively.

To compensate for the illiquidity of these tokens the Bancor network has set up smart contracts, which themselves create Smarts Tokens.

These “Smarts Tokens” are a new type of crypto specific to the Bancor protocol.

Bancor’s Goal

Bancor’s objective is simple: to increase the liquidity of the cryptocurrency market, leading to the creation of an internet of values.

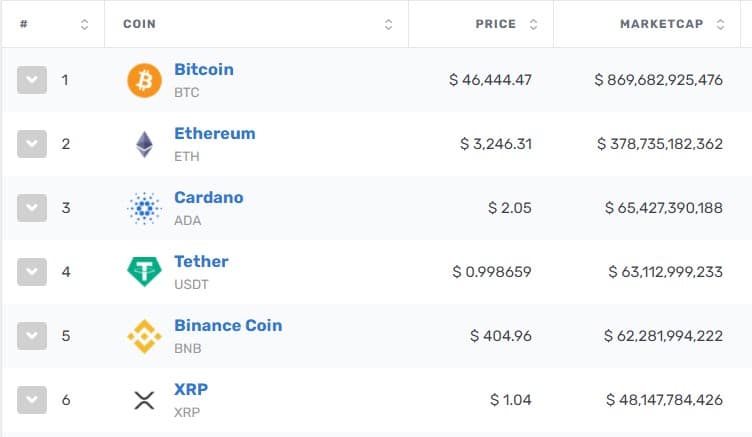

Liquidity is not really an obstacle for major cryptocurrencies – Bitcoin, Ripple, Ethereum or EOS – although they are much less liquid than some more traditional assets.

However, illiquidity is a fundamental problem for hundreds of small-cap crypto-assets.

Among these hundreds of unknown tokens, we find the usual scams, but also assets pursuing a legitimate decentralized goal, but which failed to break through lack of visibility.

According to the Bancor team, the majority of tokens face liquidity difficulties, making them difficult to trade.

Which ultimately excludes them from the ecosystem.

To compensate for the lack of liquidity, the Bancor protocol is based on Smart Tokens.

These smart tokens make it possible to do without the presence of a second part when one wants to carry out an exchange.

Self-executing contracts convert any ERC-20 token into another ERC-20 token.

All this process is internal to the Bancor blockchain.

There is not really a two-part exchange, as it would be on an exchange.

But rather, a conversion of an ERC-20 token to another since the Bancor blockchain.

The Bancor team is therefore seeking to create a real Internet of values.

This network would allow to exchange instantaneously and at low cost any type of asset once their tokenization performed.

Indeed, the Bancor protocol is compatible with all tokens derived from Ethereum’s ERC-20 standard.

And, all smart tokens created conform to the ERC-20 standard.

Product

The keystone of Bancor architecture is the smart token.

These tokens are “natively liquid”, their main feature is that they can be bought or sold at any time, through their smart contract.

This allows to do without an exchange and even a second party with whom to conclude the transaction.

A Smart Token can be converted instantly into any ERC-20 token.

In a way, the smart token is a currency that contains other currencies.

According to the Bancor team, three key features of smart tokens need to be kept in mind:

First of all, as previously stated smart tokens are a currency that “holds” one or more other currencies.

We talk about possessing tokens for the smart token, and reserve tokens for the currencies they hold.

The role of the self-executing contract here will be to ensure that the owner token holds at least one other token.

Anyone can acquire a smart token with reserve tokens by transferring the reserve token to the smart contract.

Unlike the token exchange operations taking place at ICOs taking place on Ethereum, the reverse process is possible. So you can liquidate your smart tokens and get spare tokens in exchange.

Smart tokens set their own price, relative to the reserve tokens they hold.

Their price increases when smart tokens are purchased and decreases when sold.

In addition, the smart contract ensures that a fixed reserve rate is maintained.

This ratio is called the Constant Reserve Rate (CRR) or Constant Reserve Ratio.

Each reserve token has its own CRR.

Exchanges are intermediaries that match supply and demand and charge fees for their services.

When we do not find two parties that have opposite desires – buying and selling – we are facing what is called in liquidity risk finance.

When this risk is proven then the transaction is impossible, which happens more often than we think for small caps.

Smart tokens override liquidity risk as long as they are natively liquid.

As a result, the role of exchanges is changing from crucial to superfluous.

The need to find a second party with whom to make the transaction is no longer one.

The Bancor protocol has its own native token, the BNT – Bancor Network Token – which also complies with the ERC-20 standard.

Which makes the BNT the first smart token in place on the Bancor network.

In addition, the BNT is kept by all other smart tokens.

BNT’s absolute connectivity limits the number of conversions needed to arrive at the desired spare token.

Consensus Protocol

Bancor is based on Ethereum’s proof of work protocol.

However, a migration to the protocol proof of stake Casper is expected in the coming months.

Advantages and disadvantages of Bancor

The advantages of Bancor

Bancor has identified a serious problem: illiquidity.

And, brings a solution of the most satisfactory.

A wide range of ERC-20 token available.

Bancor is great for some unknown tokens.

The use of smart tokens is new.

The Bancor team seems to have developed this promising innovation.

The method of price adjustment is different from that of an exchange, since no shorts are possible on the pairs.

The disadvantages of Bancor

Minimalist conversion interface.

There is no platform as such and therefore no trade possible except conversions.

No fiat deposit.

You need a currency supported by smart tokens before you can convert.

The use of the Bancor protocol requires a good knowledge of the Ethereum ecosystem.

Conclusion about Bancor

Bancor, launched in June 2017, is still in its early years.

The Bancor team has shown inventiveness to solve the problem of liquidity of tokens.

This could make Bancor the reference platform for the exchange of ERC-20 tokens.

Although the BNT has risen to the top 100 of capitalizations, its rise is less spectacular than one might think. Certainly limited by its system of proof of work Bancor failed to break through the top 50.

The infinite potential of convertibility of this protocol is the bet of the tokenization of the economy.

This vision involves thousands of locally effective, internationally tradable and instantly convertible Bancor tokens, provided all these tokens do their ICO on the Ethereum blockchain.