Nexo has paid crypto dividends to the holders of the Nexo token!

Nexo has paid crypto dividends to the holders of the Nexo token!

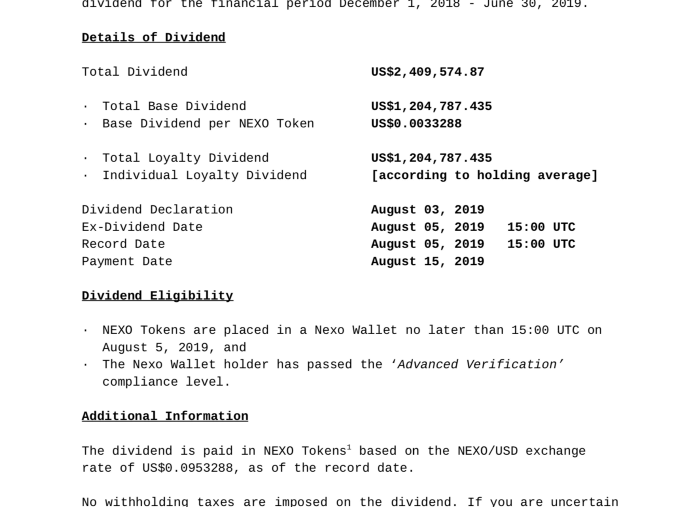

Nexo, a cryptocurrency lender, paid its token holders $2,409,574 in dividends as stated in an article on Nexo’s official blog on Medium.

Nexo would have an annualized dividend yield of approximately 12.73%.

What is interesting about this crypto news is that it is one of the only crypto companies on the market that earns money and pays crypto dividends to its Nexo token holders.

Even if Nexo is only a company that offers loans in cryptocurrency so nothing new in terms of blockchain technology, Nexo could lend Euros or Dollars instead of Bitcoin or Ethereum.

But it is still a player in the crypto sector that is getting momentum in crypto lending, who earns money and pays dividends. So this is a very positive news for the crypto market!

So, there is a crypto company that earns money today (there are others of course like Coinbase, Binance, …) while the majority of cryptos projects have not yet delivered their products, dapp or blockchain software.

Nexo is an operational crypto company like Kryll.io for example, Kryll offers trading tools to automate cryptocurrency trading, the platform is already working and is operational as is the crypto activity of Nexo then.

In the team’s official publication on Medium, Nexo reveals that users only need to connect to their Nexo Mobile app to see their dividends, which they will see in their cryptocurrency wallet.

From there, the article explains a little more in detail the dividend strategy:

“Nexo’s innovative dividend distribution methodology rewards long-term investor confidence and also reduces market volatility around dividend-off dates.

It consists of two parts: the Nexo base dividend and the Nexo loyalty dividend, each representing 50% of the total amount of the current distribution.

Nexo’s innovative and impeccable marketing strategies, unparalleled customer support, combined with a substantial increase in the price of encryption assets across the market, have provided unprecedented demand for Nexo’s Instant Crypto Credit Lines ™ product.

This has given us the means to give back to the community by allowing investors around the world to generate 8% with Nexo’s high-yield “Earn Interest” product.

The launch of the Nexo Mastercard card, the acquisition of commercial banking capabilities and the reduction of the gap between traditional finance and decentralized finance are all factors that ensure Nexo’s dominant position in the market and the sustainability of our growth rates. long-term.”

The platform has its own Mastercard card, which has also been launched recently, a Bitcoin credit card somehow that allows to spend cryptocurrency.

“In addition to regular and growing dividend payments,” the team is developing even more features for its users:

Best interest rates on all Nexo products.

Features and premium features.

Higher cash back on the Nexo card.

Exclusive Nexo Card Design.

Affiliation commissions.

Access by invitation only for products and events.

Nexo has already achieved a great success in the crypto sector by publishing its first dividend payout to holders of the Nexo token.

Indeed, buying and keeping a token is only of interest if the token will gain value or pay dividends through its use in the crypto project activity as it should be indicated in the business plan and the white paper of the crypto project.

Nexo is a crypto lending company, you deposit your cryptos, you can get a line of credit.

You earn interest via the Nexo token on your deposit in stable coins and soon on Bitcoin or Ethereum.

So there is already a market for crypto loans and Nexo seems to have taken a good position against the competition like RCN because it is a market that will clearly grow with more and more people who will use cryptocurrency and Bitcoin.

More and more people will ask to borrow Bitcoin or other cryptocurrency, a bitcoin loan somehow.