How can you know if your bank card is crypto friendly?

There are unfortunately still many banks in the United States or in other countries which block credit card payments when you want to buy Bitcoin on a crypto exchange for example.

Banks that also sometimes ban bank transfers to Bitcoin exchanges like Kraken or other cryptocurrency sellers.

Over time, the purchase of Bitcoin has become more democratic, it is even possible to buy Bitcoin with Paypal on certain sites like Etoro.

Buying Bitcoin by credi card is becoming easier, but some users sometimes have the unpleasant surprise of having their payment refused by their bank when buying cryptocurrency.

So, how do you know beforehand if your bank card is crypto friendly?

This is what the crypto startup Aximetria and its AxiCheck service offer.

In order to know if your debit card is crypto friendly, Aximetria relies on purchases of cryptocurrency and withdrawal of funds made with MasterCard, Visa and MIR cards at 427 banks in 80 countries.

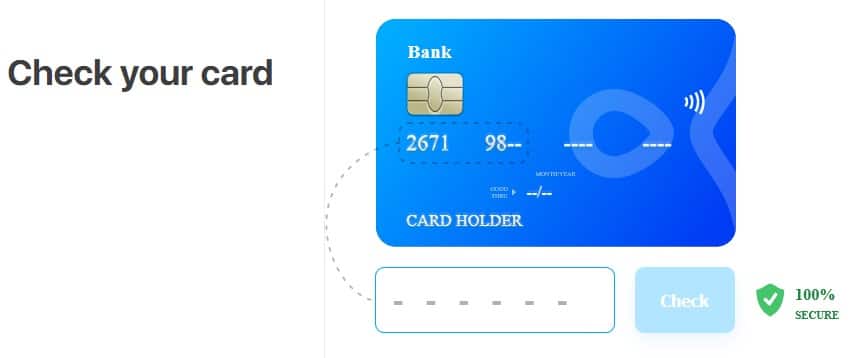

In order to test and find out if your Visa or Mastercard is crypto friendly, simply enter the first 6 digits of your credit card on the website.

You can take the test on the internet but also on Android or iOS Iphone mobile.

Cards from banks like N26, Revolut, Monzo and Tinkoff can also be tested.

By doing the test on Axicheck, the site will tell you if your bank card is 100% crypto friendly, 50% crypto friendly, or if there is a good chance that your payment will be declined if you try to buy Bitcoin with your card.

It remains to be seen the total statistical coverage that this application can cover in order to be able to test the large number of debit cards that exist in the world.

An original initiative that should interest many potential cryptocurrency buyers if they want to know if their bank card is actually crypto friendly.

You can otherwise order a Bitcoin debit card, see our ranking of the best crypto debit cards: click here.