It’s Not Just Bitcoin That Is Successful With Investors, Grayscale Sees Growing Interest In Ethereum

The market’s number 1 cryptocurrency, Bitcoin, is clearly in the spotlight with attention focused on the recent rise in the BTC price which is breaking new records in 2020.

But it’s not just Bitcoin that is attracting interest from investors, more and more of them want to invest in Ethereum and sometimes only in this crypto-asset.

The Grayscale investment fund is thus seeing more and more investor clients interested in Ethereum and who sometimes wish to invest only in this cryptocurrency, said Michael Sonnenshein, managing director of Grayscale Investments.

Grayscale manages no less than 500,000 BTC for its investor clients, but it also has a large number of ETH tokens under management as well as Litecoin LTC.

“During 2020 we see a new group of investors who are Ethereum first and in some cases only Ethereum.

There is a growing conviction around Ethereum as an asset class.”, Michael Sonnenshein told Bloomberg.

A safe bet on the market, the Ethereum blockchain is indeed the most widely used blockchain in the crypto industry, remember that 80% of Dapps and smart contracts use Ethereum!

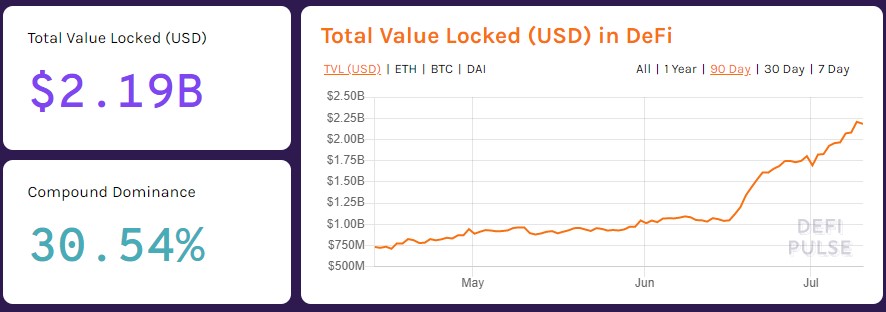

Another essential element is the arrival of DeFi decentralized finance which is only in its infancy and which also relies mainly on the Ethereum blockchain to operate.

DeFi protocols use ETH token or ERC20 derivative tokens in farming and income generation activities in liquidity pools.

DeFi decentralized finance accounts for over 90% of Dapps application activity on Ethereum.

We must also look at the rise in the Ethereum price, if the bitcoin price is up 170% since the start of the year, the ETH price is up 360%!

A rise in the price of Ethereum that has not gone unnoticed and that is attracting many investors to this reliable crypto-asset.

Finally, we must mention Ethereum staking which has just started with the launch of Ethereum ETH 2.0 on December 1st.

Any holder of ETH tokens will indeed be able to do Ethereum staking, individually with a minimum of 32 ETH or via staking platforms.

Binance has just launched its Ethereum staking platform, Kraken is no exception and has also launched its Ethereum ETH 2.0 staking services.

Interest rates that will range from 5% to 20%!

Therefore, many Ethereum investors are therefore considering staking their ETH tokens for the long term in order to generate significant profits.

Positive advantages specific to Ethereum which attract more and more investors.

Grayscale’s Ethereum Trust (ETHE) fund has around $915 million in ETH tokens under management and is said to hold more than 2% of the ETH tokens in circulation.

An Ethereum price which is currently still below 600 dollars