Bitcoin price will go back up to $20,000 in 2020, Bloomberg study finds

An optimistic prediction from the famous financial information company Bloomberg which publishes its study “Bloomberg Crypto Outlook“, with the forecast that the price of Bitcoin will return to the level of 20,000 dollars!

In its very comprehensive report, documented and supported by figures as well as the fundamental data that will make Bitcoin rise again to its highest price reached a few years ago.

A Bitcoin BTC price at 20,000 dollars is clearly eagerly awaited by the crypto community but also by all those who have bags of altcoins that are no longer worth anything.

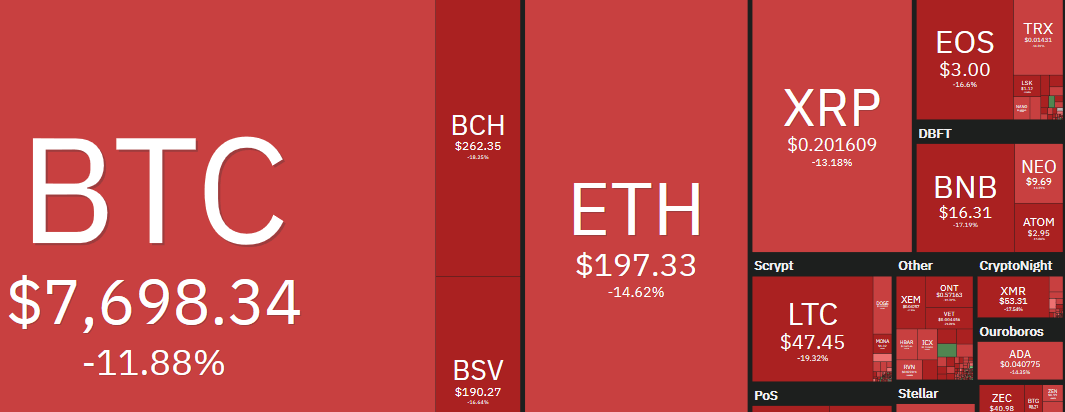

This bear market has effectively caused the price of cryptocurrencies to drop to around 90% of their highest price.

Bloomberg cites the uncertain economic environment created by the Coronavirus/Covid19 crisis, the institutions that are buying more and more Bitcoin and the rise of stablecoins.

“History shows Bitcoin at around $20,000 in 2020. Bitcoin reflects the return of 2016 to its previous peak. It was the last time the supply was cut in half and the third year after a major spike. Our graph shows Bitcoin marking the time for a third year after the parabolic rally of 2017.

After a 60% drop in 2014, at the end of 2016, cryptography corresponded to the peak of 2013. Four years later and the second year after the drop of almost 75% in 2018, Bitcoin will reach a record high of around $20,000 this year, in our opinion, if it follows the trend of 2016.” says Bloomberg in its report

In the short term, Bloomberg sees the Bitcoin BTC price at the level of 10,000 dollars at first.

The crash of the Bitcoin price in March 2020, in parallel with the stock market crash, created, according to Bloomberg, a good basis to move up again.

Bitcoin becomes a mature asset

Over time, Bloomberg finds that Bitcoin is maturing as an investment asset.

“Maturation, greater depth and much greater exposure via futures contracts should continue to suppress the volatility of the crypto firstborn, keeping it clearly oriented towards price appreciation.”

Institutions buy Bitcoin

Bloomberg looks at Grayscale, which has bought all of the Bitcoins mined since BTC’s last halving in May.

Mass purchases from investment company Grayscale Bitcoin Trust are causing the supply of Bitcoins to fall sharply, following the halving that halved the production of BTC tokens by Bitcoin miners.

“Bitcoin’s price appreciation is also due to the fact that ongoing trades, such as the Grayscale Bitcoin Trust (GBTC), absorb most of the current supply and withdraw it from the market.

GBTC absorbed 25% of all newly mined Bitcoins in 2020 compared to 10% in 2019. It should be remembered that the latest Bitcoin halving halved the block reward from 12.5 to 6.25 BTC. This has significantly reduced the current and future supply of Bitcoin, which is then further limited by the actions of GBTC.”

Bitcoin futures will help Bitcoin stay above $10,000

Another important element according to Bloomberg, Bitcoin futures trading contributes to the maturity of the Bitcoin asset and its price stability.

“Bitcoin Futures can be an engine to keep above $10,000. In our opinion, favorable trends in the Bitcoin futures trade on the CME support the price. Representing maturation towards the mainstream of assets, the increase in open term interest and the stable price premium are headwinds for volatility and downwinds for prices.

Growing interest in Bitcoin futures and maturation.

The near-doubling of futures contracts opens interest towards the level where Bitcoin exceeded $ 10,000 in 2019 indicates the rapid rate of maturation and an upward trend in prices, in our opinion. Not only do futures represent buy-in to the mainstream, trading on a US-regulated exchange is a key issue, with the SEC reluctant to approve Bitcoin ETFs.”

Stablecoins and the Coronavirus Crisis Push Towards Digitalization of Money

The effects of the Covid crisis19 only accelerated a movement towards digital currency.

Another indicator according to Bloomberg is the significant rise in stablecoins and their increasing use.

In fact, the total value of stablecoins is $10 billion in 2020 compared to $4 billion in 2019!

The effects of the Covid crisis19 only accelerated a movement towards digital currency.

“Tether, Bitcoin and scanning money in the middle of the Covid-19. The rapidly increasing market capitalization of stablecoins indicates that currencies are going digital and taking over the price of Bitcoin.

The Covid-19 accelerates the abandonment of paper money and stimulates many quantitative easing, which helps independent value havens such as gold and Bitcoin.”

A Bloomberg report which is therefore very bullish and optimistic about the future of the Bitcoin price.

To the figures and data reported by Bloomberg, we can certainly add the fact that the rise in the Bitcoin price and the Coronavirus crisis have brought a significant number of new Bitcoin traders, increasingly using automated trading with crypto trading bots.

The elements and figures quoted in this interesting report effectively indicate that the current environment in which Bitcoin finds itself can only raise the Bitcoin price in the coming months, with the prospect of a new BTC bull run as in 2017.