Bitcoin crash: according to Binance and JP Morgan, BAKKT is to blame for the last BTC price dump

Bitcoin crash: according to Binance and JP Morgan, BAKKT is to blame for the last BTC price dump.

The recent fall of the Bitcoin BTC price to $8000 surprised the crypto community and traders who are looking for an explanation for this sudden crash of the Bitcoin price the other day.

For many people, Bakkt is to blame, many were waiting for a market reversal thanks to Bakkt with the expectation of the arrival of institutional investors in the crypto market.

BAKKT praised the launch of its Bitcoin Futures platform as an “important milestone for the industry,” according to Kelly Loeffler, Bakkt’s CEO.

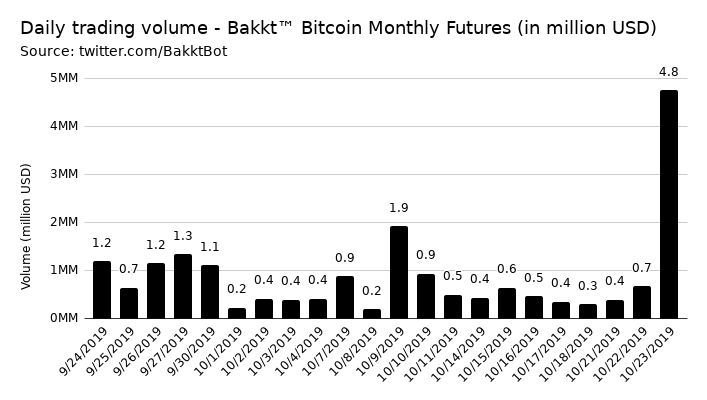

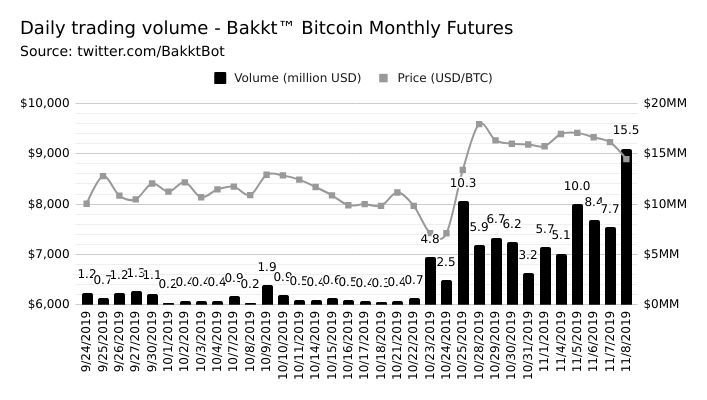

But it is the opposite that occurred with a slow start or insignificant in terms of volumes in Bitcoin BTC on its platform.

But was it predictable?

“Buy the rumor, sell the news” as the saying goes in the world of trading, smart money often expects the opposite effect of a significant news in the financial markets.

In an other article, we talk back to the causes for the recent Bitcoin crash where Bakkt may have played a role but it is certainly not the only reason.

However, Binance Research and JP Morgan blame the launch of Bakkt as the main reason for the fall of Bitcoin BTC price!

-

First, Binance and its report on the crypto market in September 2019.

Binance Research says this to explain the precipitous drop in the Bitcoin price:

“One possible reason, explaining Bitcoin’s price drop, could be the general indifference towards the much-hyped release of Bakkt, as BTC prices dropped over $1,000 a day or so after trading began.

Could it be another classic case of the “buy the news, sell the rumor” phenomenon that occurs in the crypto-industry?

Bakkt was touted by many “crypto-observers” as an additional primary channel to bring large institutional flows into cryptocurrency and digital asset markets.

It may certainly still do so in the future, as illustrated by the CME futures sluggish start and subsequent pick-up in volumes.

Short-term wise though, Bakkt’s disappointing start seems to have been a contributing factor to the recent price decline.”

Bakkt is therefore guilty for the fall of Bitcoin price according to Binance Research.

Binance research which details many other figures in its report and study of the crypto market in September 2019.

-

Then there is JP Morgan who also blames Bakkt to be responsible for the dump of the BTC token price.

In an article on Bloomberg, Nikolaos Panigirtzoglou, a JP Morgan analyst, puts forward his hypotheses and figures as to why, according to JP Morgan analysts, Bakkt is responsible for the Bitcoin BTC price dump.

The crypto community and Bitcoin traders had a lot of hope in Bakkt’s launch, thinking that Bakkt would bring Wall Street money to Bitcoin because it has the support of Wall Street regulators like the CTFC.

“It may be that the listing of physically settled futures contracts (that enables some holders of physical Bitcoin e.g. miners to hedge exposures) has contributed to recent price declines, rather than the low initial volumes,” JPMorgan said.

For JP Morgan, Bakkt is therefore responsible for this Bitcoin BTC price plunge.

Still, the launch of this Bitcoin Futures platform, which requires the purchase and sale of real Bitcoin tokens, is an open door to institutional investors who should gradually invest larger sums of money in Bitcoin and cryptocurrency.

Bakkt recorded $5 million in volume for its Bitcoin Futures the first week of operation.

This new platform must be given time to prove itself.

The Bitcoin BTC price has stabilized around $8,000 with altcoins that have risen a little since like Ethereum ETH or EOS at $3 following the news about its $24 million fine with the SEC.

The market is waiting for Bitcoin BTC to finish its correction in order to go back up again.

Arthur Hayes, CEO of Bitmex, had confirmed his forecast for a $20,000 Bitcoin BTC in the short term.

He refers in particular to the events related to the intervention of the FED which injects tens of billions of dollars into the American economy, QE or Quantitative Easing.